Extracting Cyclical Components From Economic Time Series

with tags hp-filter hodrick-prescott baxter-king hamilton business-cycles detrend wavelet emd empirical-mode-decomposition -The analysis of economic time series often requires the extraction of their cyclical components. This post presents some methods, which can be used to decompose time series into their different components. It is based on the chapter on business cycles by Stock and Watson (1999) in the Handbook of Macroeconomics, but also presents some more recent methods like Hamilton’s (2018) alternative to the HP-filter, wavelet filtering and empirical mode decomposition.

Data

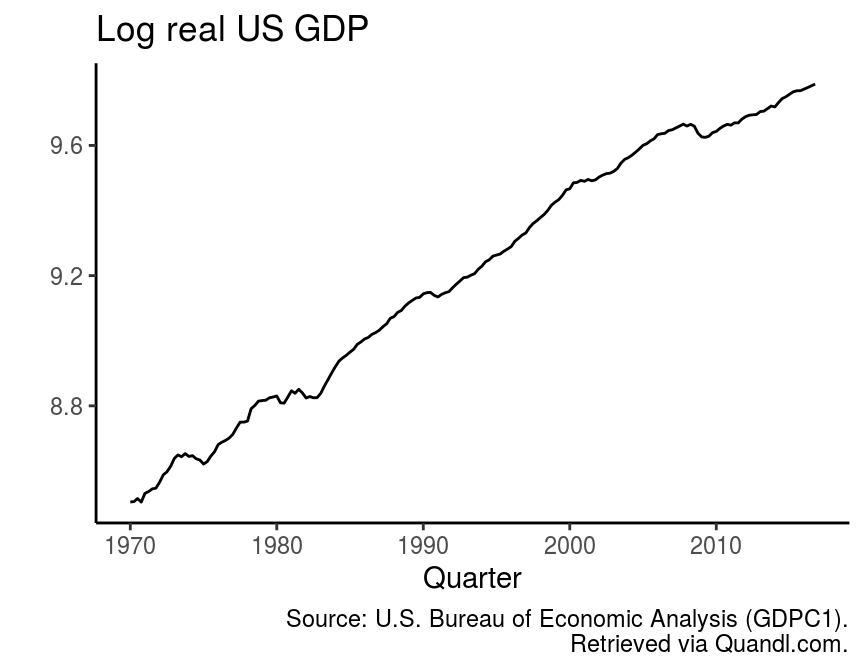

I use quarterly data of US log real GDP from 1970Q1 to 2016Q4 for the illustration of the different methods. The time series is obtained via Quandl and its respectiv R-package. The original series can be downloaded from the FRED database.

# Load packages for data download and transformation

library(dplyr)

library(Quandl)

library(tidyr)

# Download data

data <- Quandl("FRED/GDPC1", order = "asc",

start_date = "1970-01-01", end_date = "2016-10-01") %>%

rename(date = Date,

gdp = Value) %>%

mutate(lgdp = log(gdp)) # Take logsTo get an intuition about what it means to extract the cyclical component of a time series, look at the development of log real GDP over time in the following figure.

library(ggplot2)

ggplot(data, aes(x = date, y = lgdp)) +

geom_line() +

theme_classic() +

labs(title = "Log real US GDP", x = "Quarter", y = "",

caption = "Source: U.S. Bureau of Economic Analysis (GDPC1).\nRetrieved via Quandl.com.")

There is a clear increasing trend in the data, which appears to become gradually smaller up to the present. Additionally, the series seems to fluctuate around this trend in a more or less regular manner. There are relatively long lasting deviations from the trend, which could be considered to be cyclical fluctuations. The identification of those cyclical components is an important question in economics, because it might have serious implications for economic policy.

Deviation from a linear trend

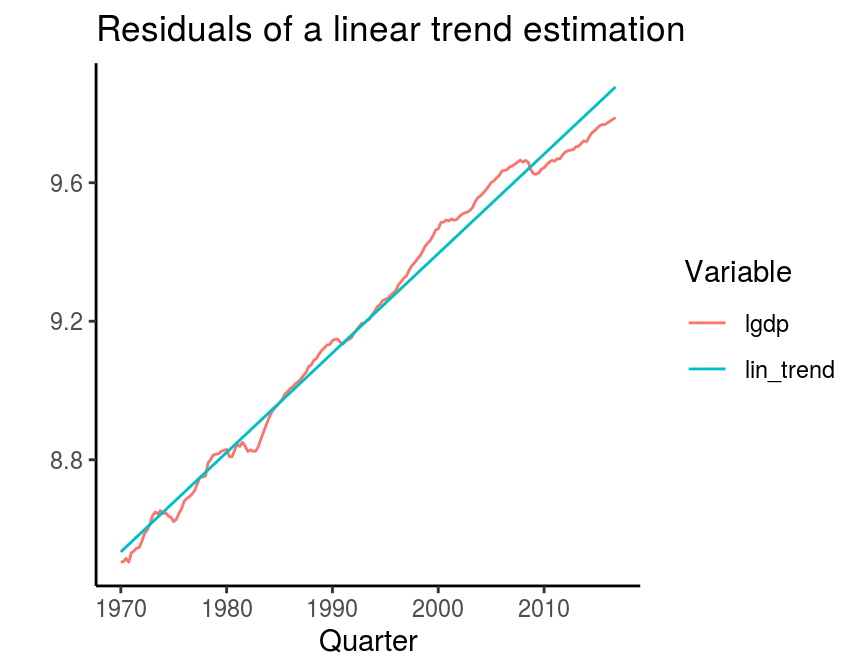

A first approach to extract a trend from a series is to regress the variable of interest on a constant and a trend term and to obtain the fitted values. These are plotted in the following figure.

# Add a trend

data <- data %>%

mutate(trend = 1:n())

# Estimate the model with a constant and a trend

time_detrend <- fitted(lm(lgdp ~ trend, data = data))

names(time_detrend) <- NULL

# Add series to main data frame

data <- data %>%

mutate(lin_trend = time_detrend)

# Create data frame for the plot

temp <- data %>%

select(date, lgdp, lin_trend) %>%

gather(key = "Variable", value = "value", -date)

# Plot

ggplot(temp, aes(x = date, y = value, colour = Variable)) +

geom_line() +

theme_classic() +

labs(title = "Residuals of a linear trend estimation",

x = "Quarter", y = "")

This approach is relatively controversial, since it assumes that there is a constant, linear time trend. As we have seen above, this is not very likely given the steady decrease of the trend’s growth rate over time. However, it is still possible to assume a different functional form of the time trend, e.g. a quadratic term, to account for the specifities of a trend. A further disadvantage of this method is that it does only exlude the trend, but not the noise, i.e. the very small fluctuations in the series.

Hodrick-Prescott filter

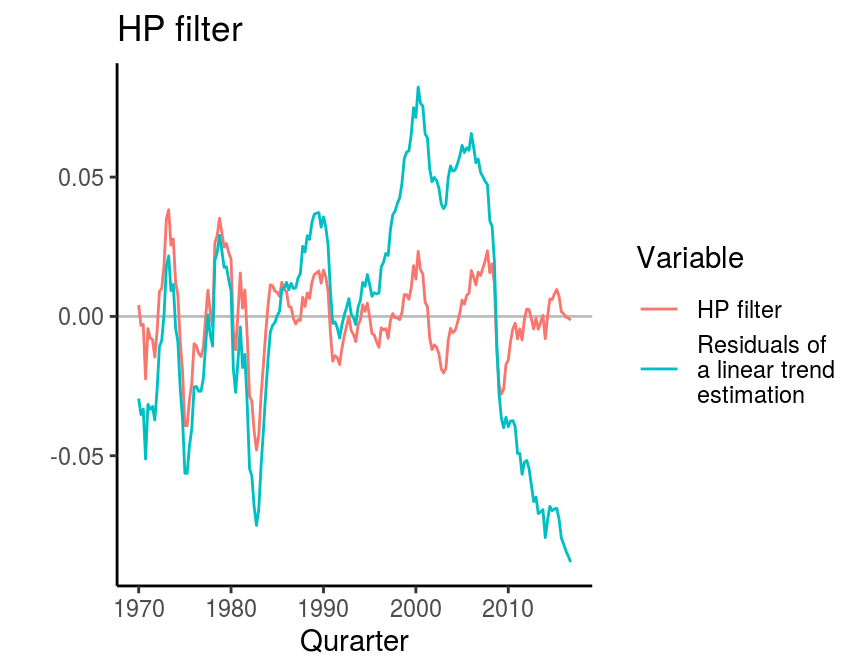

Hodrick and Prescott (1981) developed a filter, which seprates a time series into a trend and cyclical component. In contrast to the linear trend the so-called HP filter estimates a trend, which changes over time. And the degree to which this trend is allowed to change, the smoothing parameter λ, is determined manually by the researcher.

The hpfilter function is contained in the mFilter package and requires the time series and the smoothing parameter. The literature suggests a value of 1600 for quarterly data. However, it is possible to choose a much higher value as well. The follwoing figure plots the values of the cyclical component of real GDP obtained by the HP filter and compares it to the values of a linearly detrended series. The behaviour of both series appears to be quite similar at the beginning of the series.

# Load the package

library(mFilter)

# Run HP filter

hp_gdp <- hpfilter(data$lgdp, freq = 1600)

# Add the cyclical component of the HP filter and

# the linearly detrended sereis to the main data frame

data <- data %>%

mutate(hp = hp_gdp$cycle,

lin_cycle = lgdp - lin_trend)

# Create data frame for the plot

temp <- data %>%

select(date, hp, lin_cycle) %>%

gather(key = "Variable", value = "value", -date) %>%

filter(!is.na(value)) %>%

mutate(Variable = factor(Variable, levels = c("hp", "lin_cycle"),

labels = c("HP filter", "Residuals of\na linear trend\nestimation")))

# Plot

ggplot(temp, aes(x = date, y = value, colour = Variable)) +

geom_hline(yintercept = 0, colour = "grey") +

geom_line() +

theme_classic() +

labs(title = "HP filter",

x = "Qurarter", y = "")

Although widely used in economics, the HP filter is also heavily criticised for some features. See, for example, a good overview in a Bruegel blog post by Jérémie Cohen-Setton and Yury Yatsynovich and here for the working paper version of a critique by James Hamilton.

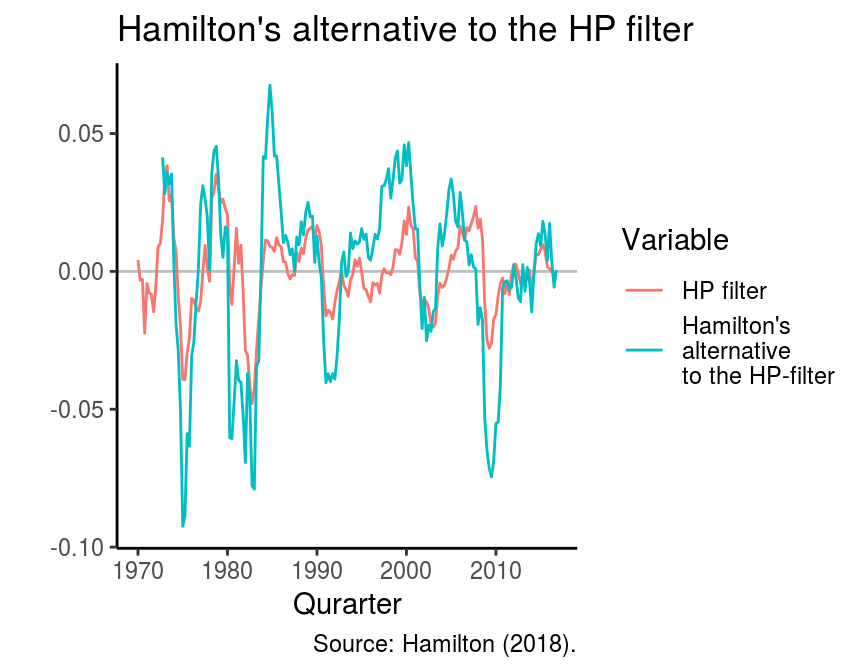

A regression based alternative to the HP filter

Hamilton (2018) also proposes an alternative approach to the HP filter It boils down to a simple regression model, where the hth lead of the times series is regressed on the most recent p values of the time series. As recommended in the paper I use h=8 and p=4 in the following example. The package neverhpfilter by Justin M. Shea contains the function yth_filter, which requires an xts object as input.

library(neverhpfilter)

# Get the series

y <- as.xts(ts(data$lgdp, start = 1970, frequency = 4))

# Dimnames must be specified, otherwise the function won't accept the input

dimnames(y) <- list(NULL, "log_gdp")

# Estimate

hamilton_temp <- yth_filter(y, h = 8, p = 4)

# Add residuals to the main data frame

data <- data %>%

mutate(hamilton = as.numeric(hamilton_temp$log_gdp.cycle))

# Prepare dataset for plot

temp <- data %>%

select(date, hamilton, hp) %>%

gather(key = "Variable", value = "value", -date) %>%

filter(!is.na(value)) %>%

mutate(Variable = factor(Variable,

levels = c("hp", "hamilton"),

labels = c("HP filter", "Hamilton's\nalternative\nto the HP-filter")))

# Plot

ggplot(temp, aes(x = date, y = value, colour = Variable)) +

geom_hline(yintercept = 0, colour = "grey") +

geom_line() +

theme_classic() +

labs(title = "Hamilton's alternative to the HP filter",

x = "Qurarter", y = "",

caption = "Source: Hamilton (2018).")

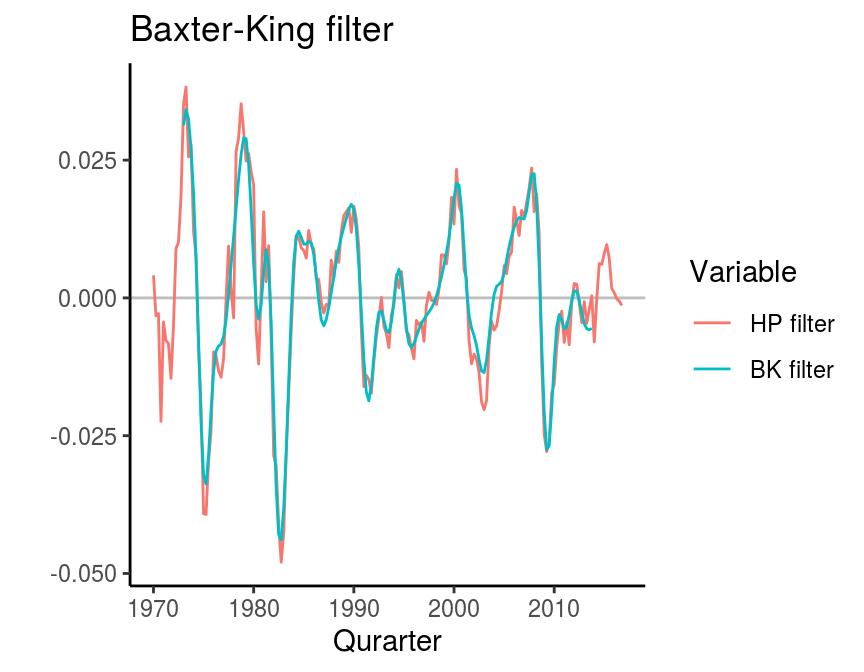

Baxter King filter

Baxter and King (1994, 1999) proposed a filter, which yields very similar results as the HP filter. Additionally, it takes out the noise from the time series, so that a smooth estimate of the cyclical component can be obtained. The function bkfilter is also contained in the mFilter package. It requires the series, a lower and an upper bound of the amount of periods, where cycles are assumed to occur (pl and pu), and a smoothing factor nfix. The literature (e.g. NBER, Stock and Watson (1999)) suggests that business cycles last from 6 to 32 months. These values were used to specify the lower and upper bound of the cycle periodicity. The results of the BK filter are shown in the following figure. A relatively serious drawback of this method is that the smoothing factor leads to the loss of observations at the beginning and the end of the series. This might be a problem with small samples and when the current state of the economy is of interest.

# Run BK filter

bk_gdp <- bkfilter(data$lgdp, pl = 6, pu = 32, nfix = 12)

# Add cyclical component to the main data frame

data <- data %>%

mutate(bk = bk_gdp$cycle[, 1])

# Create data frame for the plot

temp <- data %>%

select(date, hp, bk) %>%

gather(key = "Variable", value = "value", -date) %>%

filter(!is.na(value)) %>%

mutate(Variable = factor(Variable,

levels = c("hp", "bk"),

labels = c("HP filter", "BK filter")))

# Plot

ggplot(temp, aes(x = date, y = value, colour = Variable)) +

geom_hline(yintercept = 0, colour = "grey") +

geom_line() +

theme_classic() +

labs(title = "Baxter-King filter",

x = "Qurarter", y = "")

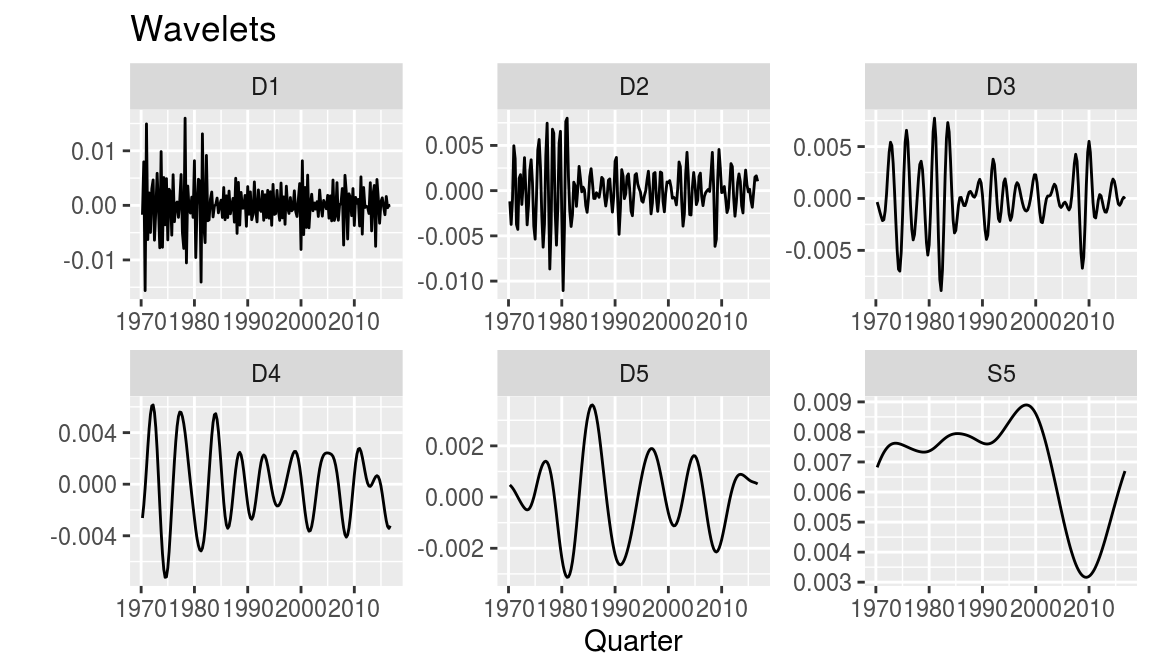

Wavelet filter

Yogo (2008) proposed to use wavelet filters to extract business cycles from time series data. The advantage of this method is that the function does not only allow to extract the trend, cycle and noise of a series, but also to become more specific about the periods within which cycles occur. However, there is not full freedom in that, since the technique can only capture periodicities of a power of two, i.e. 2, 4, 8, 16, 32 and so on.

The methods implementation in R is also neat, but requires some additional data transformation before it can be used. A useful function is contained in the waveslim package and is called mra (“multiresolution analysis”). It requires a differenced version of the time series and the depth of the decomposition.

# Load package

library(waveslim)

# Calculate first difference of log GDP

data <- data %>%

mutate(dlgdp = lgdp - lag(lgdp, 1))

# Get data

y <- na.omit(data$dlgdp)

# Run the filter

wave_gdp <- mra(y, J = 5)

# Transform mra-output to data frame

wave_gdp <- as_tibble(wave_gdp)

# Create data frame for plotting

temp <- wave_gdp %>%

gather(key = "imf", value = "value") %>%

group_by(imf) %>%

mutate(date = data$date[-1])

# Plot mra output

ggplot(temp, aes(x = date, y = value)) +

geom_line() +

facet_wrap( ~ imf, scales = "free") +

labs(title = "Wavelets",

x = "Quarter", y = "")

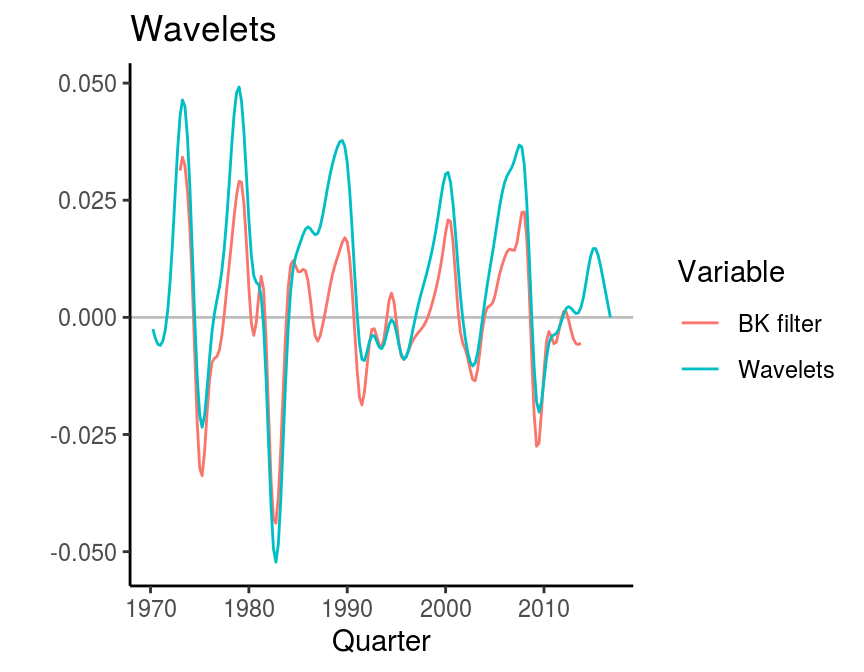

The function gives multiple series, which have to be cumulated with cumsum to translate them back into the level data. Maybe not surprisingly, the wavelet filter yields a similar result as the BK filter, since the upper bound of cycle periods is equal in both and the lower bound differs only by two - 23=8 compared to the 6 in the BK filter.

data <- data %>%

mutate(wave = c(NA, cumsum(wave_gdp$D3 + wave_gdp$D4 + wave_gdp$D5)))

temp <- data %>%

select(date, bk, wave) %>%

gather(key = "Variable", value = "value", -date) %>%

filter(!is.na(value)) %>%

mutate(Variable = factor(Variable, levels = c("bk", "wave"),

labels = c("BK filter", "Wavelets")))

ggplot(temp, aes(x = date, y = value, colour = Variable)) +

geom_hline(yintercept = 0, colour = "grey") +

geom_line() +

theme_classic() +

labs(title = "Wavelets",

x = "Quarter", y = "")

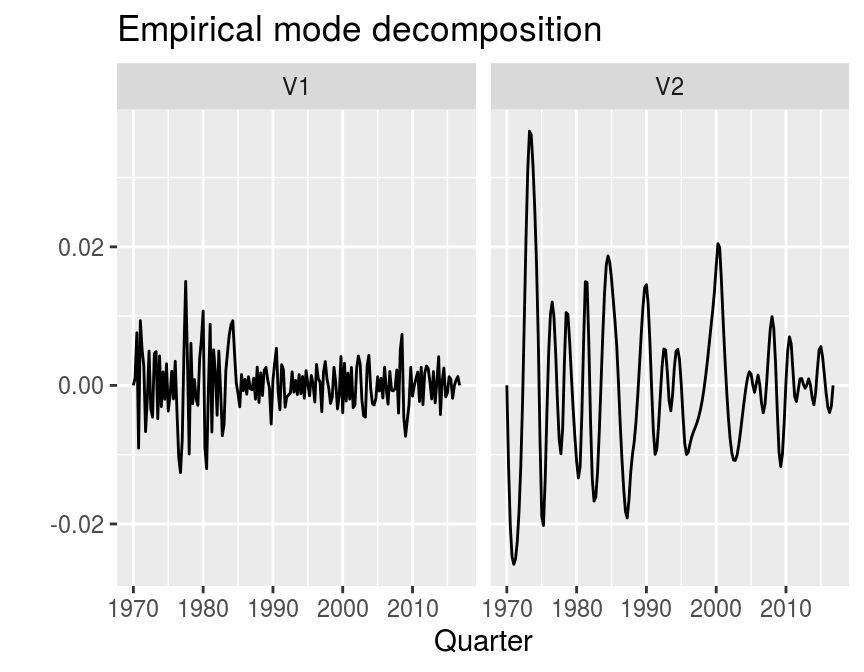

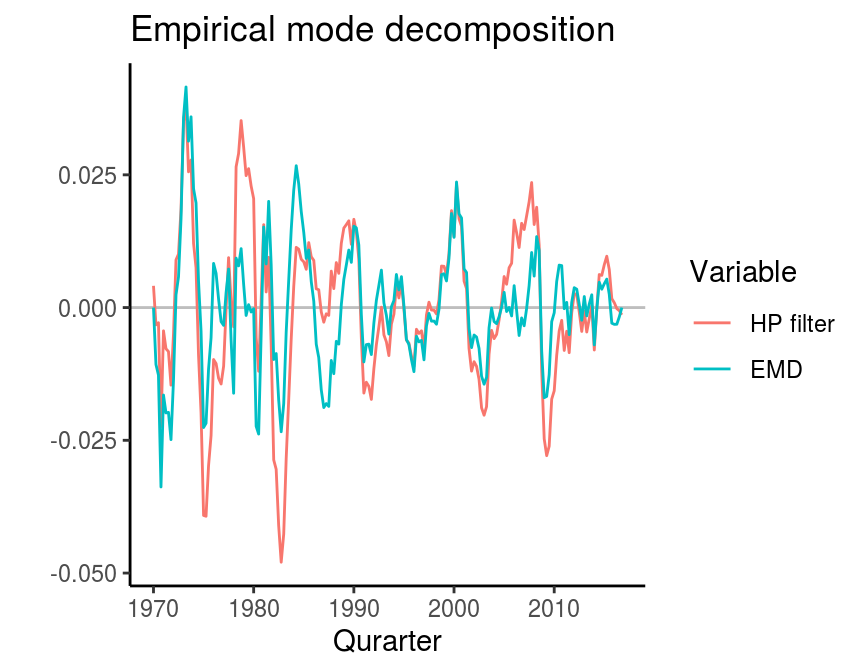

Empirical mode decomposition (EMD)

Kozic and Sever (2014) propose empirical mode decomposition as a further method of business cycle extraction as presented in Huang et al. (1998). An implementation of the method comes with the emd function in the EMD package. It requires a time series, which can be both stationary or non-stationary and a boundary condition. The basic idea of EMD is similar to wavelets. It decomposes a time series into sub-series, which are called intrinsic mode functions (IMF).

library(EMD)

y <- na.omit(data$lgdp)

# Run EMD

emd_gdp <- emd(xt = y, boundary = "none")

# Exctract the intrinsic mode functions

imf_gdp <- as.data.frame(emd_gdp$imf)

# Create a data frame for plotting

temp <- imf_gdp %>%

gather(key = "imf", value = "value") %>%

group_by(imf) %>%

mutate(date = data$date)

# Plot the EMD output

ggplot(temp, aes(x = date, y = value)) +

geom_line() +

facet_wrap( ~ imf) +

labs(title = "Empirical mode decomposition",

x = "Quarter", y = "")

# Add EMD output to main data frame

data <- data %>%

mutate(emd = lgdp - emd_gdp$residue)

# Create data frame for plotting

temp <- data %>%

select(date, hp, emd) %>%

gather(key = "Variable", value = "value", -date) %>%

filter(!is.na(value)) %>%

mutate(Variable = factor(Variable, levels = c("hp", "emd"),

labels = c("HP filter", "EMD")))

# Plot

ggplot(temp, aes(x = date, y = value, colour = Variable)) +

geom_hline(yintercept = 0, colour = "grey") +

geom_line() +

theme_classic() +

labs(title = "Empirical mode decomposition",

x = "Qurarter", y = "")

Note that the first and last elements are equal to zero. This is because we used the argument boundary = "none". If we used a different specification, the function would eliminate this boundary effect by extending the original series.

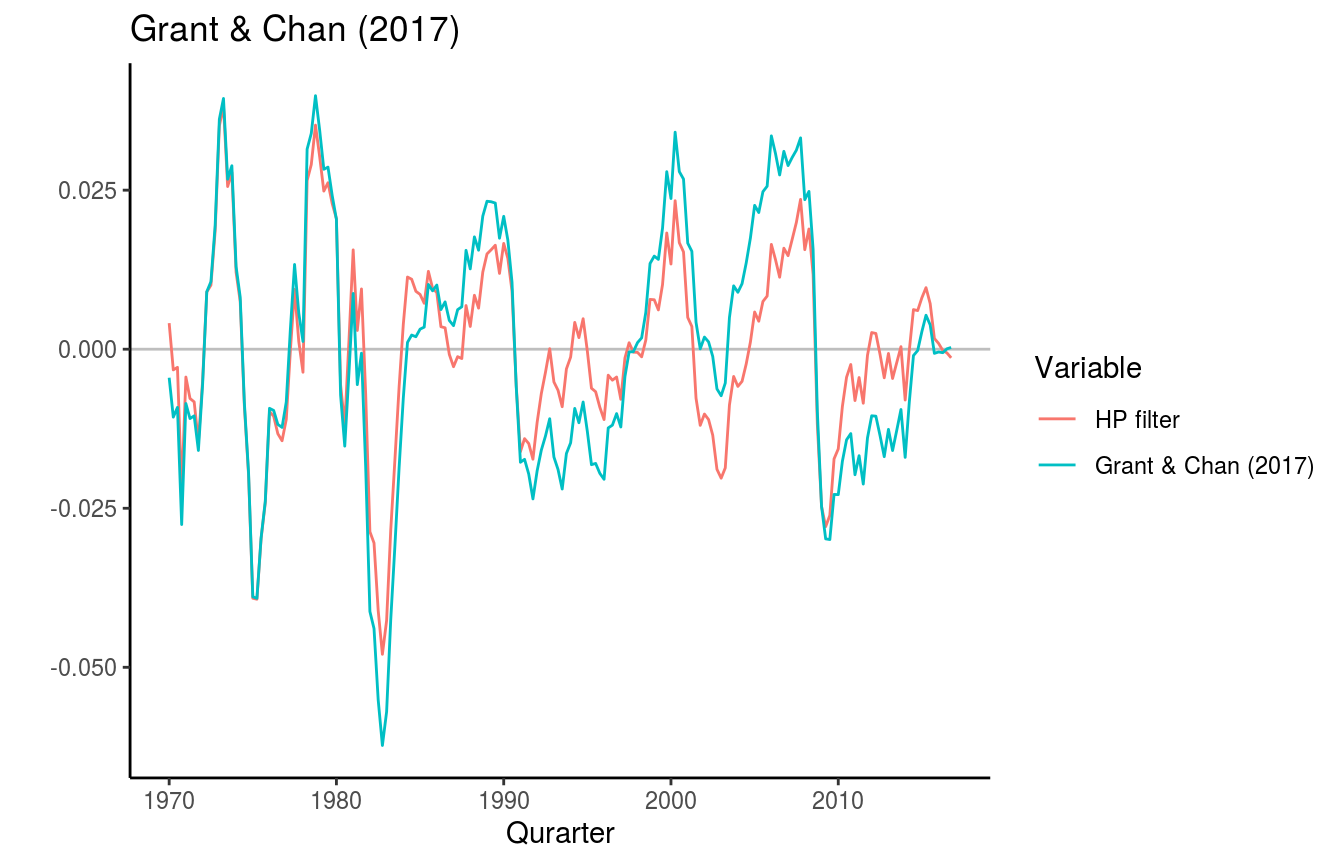

Grant, A. L., & Chan, J. C. C. (2017)

The followning code follows the description in Chan et al. (2019). The MATLAB code can be found on the textbook’s website.

Priors

# Rescaled data

y <- na.omit(data$lgdp) * 100

tt <- length(y) # T

p <- 2 # Lags of phi

# Priors of phi

prior_phi_mu <- matrix(c(1.3, -.7))

prior_phi_v_i <- diag(1, p)

# Priors of gamma

prior_gamma_mu <- matrix(c(850, 850)) # Should be close to first value of the series

prior_gamma_v_i <- diag(1 / 100, p)

# Priors for sigma2_tau

prior_s_tau <- .01

# Priors for sigma2_c

prior_s_c_shape <- 3

prior_s_c_rate <- 2Initial values

# X_gamma

x_gamma <- cbind(2:(tt + 1), -1:-tt)

# H_2

h2 <- diag(1, tt)

diag(h2[-1, -tt]) <- -2

diag(h2[-(1:2), -((tt - 1):tt)]) <- 1

h2h2 <- crossprod(h2)

# H_phi

h_phi <- diag(1, tt)

phi <- matrix(c(1.34, -.7))

for (i in 1:p) {

diag(h_phi[-(1:i), -((tt - i):tt)]) <- -phi[i,]

}

# Inverse of sigma tau

s_tau_i <- 1 / .001

# Inverse of sigma c

s_c_i <- 1 / .5

# gamma

gamma <- t(rep(y[1], 2)) # Should be close to first value of the seriesGibbs sampler

iterations <- 11000

burnin <- 1000

# Data containers for draws

draws_tau <- matrix(NA, tt, iterations - burnin)

draws_c <- matrix(NA, tt, iterations - burnin)

# Start Gibbs sampler

for (draw in 1:iterations) {

# Draw tau

alpha <- solve(h2, matrix(c(2 * gamma[1] - gamma[2], -gamma[1], rep(0, tt - 2))))

sh2 <- s_tau_i * h2h2

shphi <- s_c_i * as.matrix(crossprod(h_phi))

K_tau <- sh2 + shphi

mu_tau <- solve(K_tau, sh2 %*% alpha + shphi %*% y)

tau <- mu_tau + solve(chol(K_tau), rnorm(tt))

# Draw phi

c <- c(rep(0, p), y - tau)

temp <- embed(c, 1 + p)

c <- matrix(temp[, 1])

x_phi <- temp[, -1]

K_phi <- prior_phi_v_i + s_c_i * crossprod(x_phi)

mu_phi <- solve(K_phi, prior_phi_v_i %*% prior_phi_mu + s_c_i * crossprod(x_phi, c))

phi_can <- mu_phi + solve(chol(K_phi), rnorm(p))

if (sum(phi_can) < .99 & phi_can[2] - phi_can[1] < .99 & phi_can[2] > -.99) {

phi <- phi_can

for (i in 1:p) {

diag(h_phi[-(1:i), -((tt - i):tt)]) <- -phi[i,]

}

}

# Draw variance c

s_c_i <- rgamma(1, shape = 3 + tt / 2, rate = 2 + crossprod(c - x_phi %*% phi) / 2)

# Draw variance tau

tausq_sum <- sum(diff(diff(c(gamma[2:1], tau)))^2)

s_tau_can <- seq(from = runif(1) / 1000,

to = prior_s_tau - runif(1) / 1000, length.out = 500)

lik <- -tt / 2 * log(s_tau_can) - tausq_sum / (2 * s_tau_can)

plik <- exp(lik - max(lik))

plik <- plik / sum(plik)

plik <- cumsum(plik)

s_tau_i <- 1 / s_tau_can[runif(1) < plik][1]

# Draw gamma

sxh2 <- s_tau_i * crossprod(x_gamma, h2h2)

K_gamma <- as.matrix(prior_gamma_v_i + sxh2 %*% x_gamma)

mu_gamma <- solve(K_gamma, prior_gamma_v_i %*% prior_gamma_mu + sxh2 %*% tau)

gamma <- mu_gamma + solve(chol(K_gamma), rnorm(2))

# Save draws

if (draw > burnin) {

pos_draw <- draw - burnin

draws_tau[, pos_draw] <- tau

draws_c[, pos_draw] <- c

}

}Plot cyclical component

mean_c <- apply(draws_c, 1, mean) / 100

# Add cyclical component to the main data frame

data <- data %>%

mutate(grant = mean_c)

# Create data frame for the plot

temp <- data %>%

select(date, hp, grant) %>%

gather(key = "Variable", value = "value", -date) %>%

filter(!is.na(value)) %>%

mutate(Variable = factor(Variable,

levels = c("hp", "grant"),

labels = c("HP filter", "Grant & Chan (2017)")))

# Plot

ggplot(temp, aes(x = date, y = value, colour = Variable)) +

geom_hline(yintercept = 0, colour = "grey") +

geom_line() +

theme_classic() +

labs(title = "Grant & Chan (2017)",

x = "Qurarter", y = "")

References

Balcilar, M. (2018). mFilter: Miscellaneous Time Series Filters. R package version 0.1-4. https://CRAN.R-project.org/package=mFilter

Baxter, M., & King, R. O. (1999). Measuring Business Cycles: Approximate Band-Pass Filters for Economic Time Series. Review of Economics and Statistics, 81(4), 575–593.

Chan, J., Koop, G., Poirier, D. J., & Tobias J. L. (2019). Bayesian econometric methods (2nd ed.). Cambridge: Cambridge University Press.

Grant, A. L., & Chan, J. C. C. (2017). Reconciling output gaps: Unobserved components model and Hodrick-Prescott filter, Journal of Economic Dynamics and Control, 75, 114-121.

Hamilton, J. D. (2018), Why you should never use the Hodrick-Prescott filter. Review of Economics and Statistics, 100(5), 831-843. https://doi.org/10.1162/rest_a_00706

Kim, D. and Oh, H.-S. (2014). EMD: Empirical Mode Decomposition and Hilbert Spectral Analysis. R package version 1.5.7.

Kožić, I., & Sever, I. (2014). Measuring business cycles: Empirical Mode Decomposition of economic time series. Economics Letters, 123(3), 287–290. https://doi.org/10.1016/j.econlet.2014.03.009

McTaggart, R., Daroczi, G., & Leung, C. (2018). Quandl: API Wrapper for Quandl.com. R package version 2.9.1. https://CRAN.R-project.org/package=Quandl

Shea, J. M. (2018). neverhpfilter: A Better Alternative to the Hodrick-Prescott Filter. R package version 0.2-0. https://CRAN.R-project.org/package=neverhpfilter

Stock, J. H., & Watson, M. W. (1999). Business Cycle Fluctuations in US Macroeconomic Time Series. In J. B. Taylor & M. Woodford (Eds.), Handbook of Macroeconomics. Handbook of Macroeconomics (pp. 3–64). Elsevier.

Whitcher, B. (2015). waveslim: Basic wavelet routines for one-, two- and three-dimensional signal processing. R package version 1.7.5. https://CRAN.R-project.org/package=waveslim

Wickham, H. (2016). ggplot2: Elegant Graphics for Data Analysis. Springer-Verlag New York.

Wickham, H., François, R., Henry, L., & Müller, K. (2018). dplyr: A Grammar of Data Manipulation. R package version 0.7.8. https://CRAN.R-project.org/package=dplyr

Yogo, M. (2008). Measuring business cycles: A wavelet analysis of economic time series. Economics Letters, 100(2), 208–212. https://doi.org/10.1016/j.econlet.2008.01.008